Use Crypto Tax Report with your clients to seamlessly and accurately reconcile and file their cryptocurrency taxes.

If you’re seeking to expand your service offerings, attract crypto-savvy clients, and streamline your crypto tax workflow, then you’ve just found your ally.

The digital currency market is booming, and with Crypto Tax Report, you can leverage this growth to enhance your firm’s profitability. Provide top-notch crypto tax services, and become the go-to expert for investors and traders.

Simplify your processes with Crypto Tax Report’s extensive integration capabilities. From exchanges to wallets, our platform supports a comprehensive range of data sources, ensuring you have all your client’s crypto transactions at your fingertips.

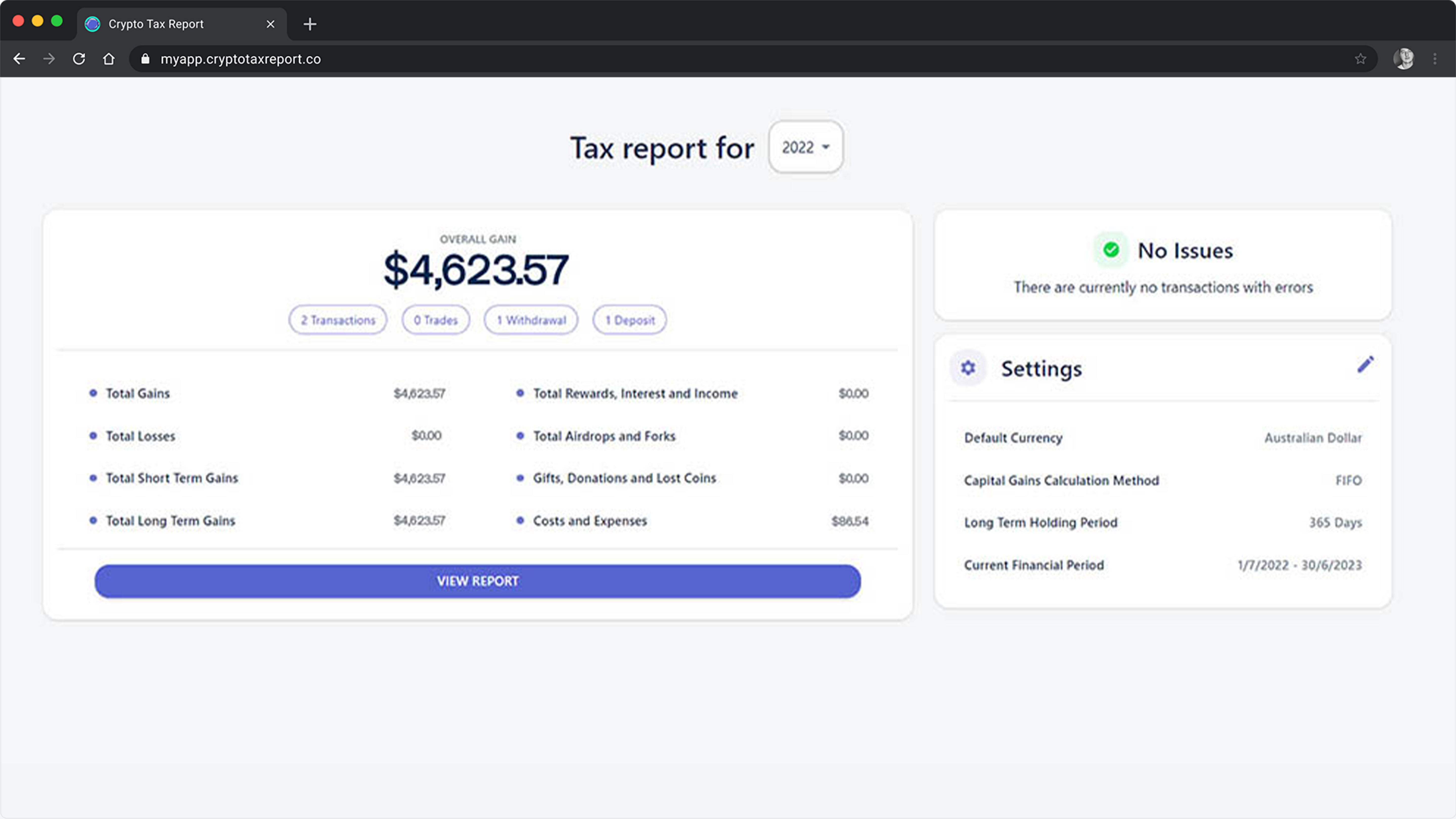

Our software generates precise and detailed reports for various tax jurisdictions, including but not limited to the IRS and ATO. You’ll have every report you need to deliver excellence in crypto taxation.

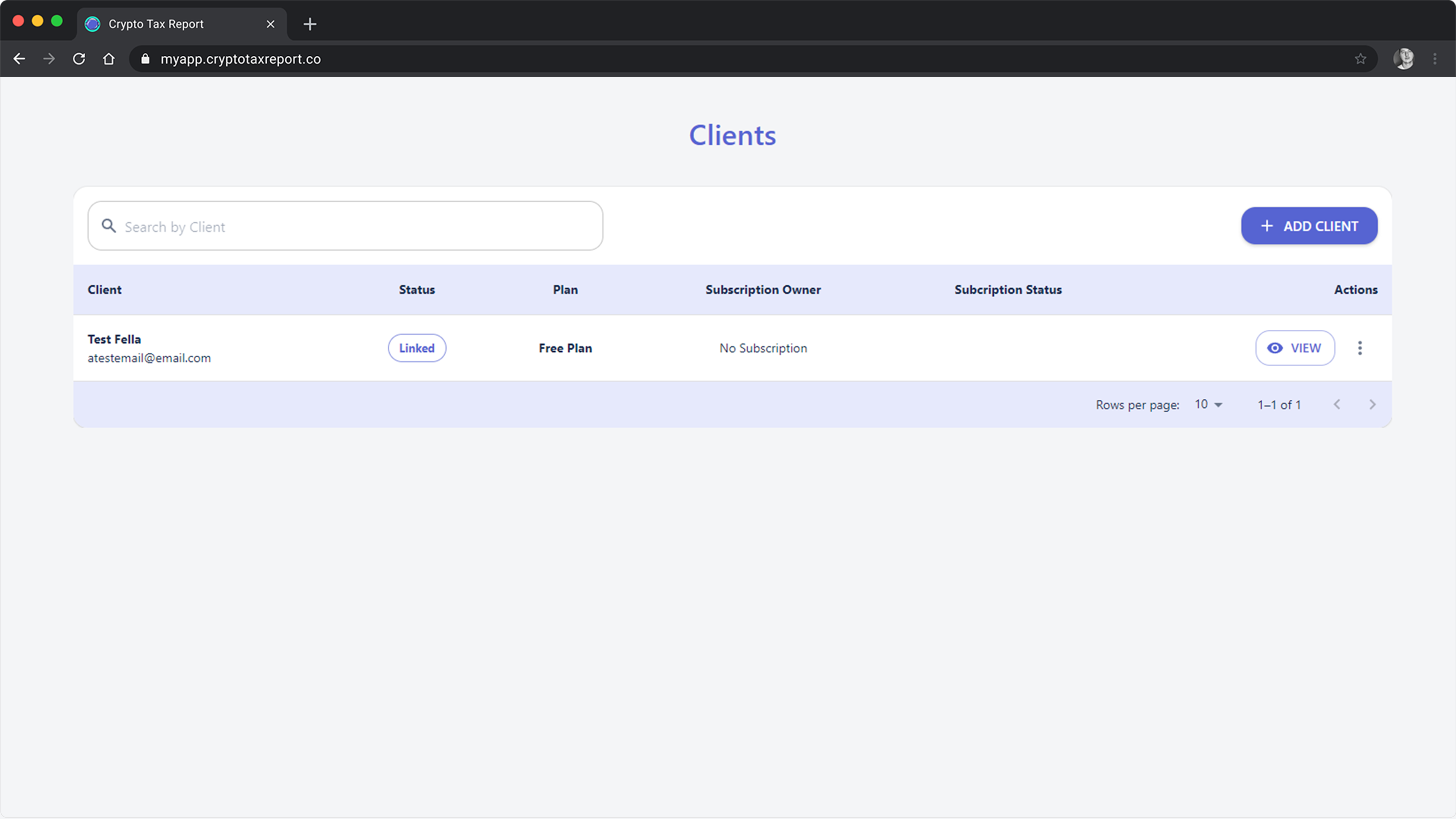

Our robust platform is designed to handle multiple clients with ease, enabling you to manage their portfolios securely while maintaining individual privacy and data integrity.

Say goodbye to manual errors. Our intelligent AI algorithms scrutinize every transaction, categorize them accurately, and ensure your reports reflect the most precise tax obligations for your clients.

Choose Crypto Tax Report and redefine what it means to offer cutting-edge, comprehensive, and stress-free crypto tax services. Get started today and experience a seamless transition to the forefront of cryptocurrency taxation.