Embrace a stress-free tax season with our comprehensive crypto tax solution. Whether you’re an individual trader, a corporate entity managing digital assets, or an accountant delving into complex transactions, our platform is tailored to meet your needs with precision and ease.

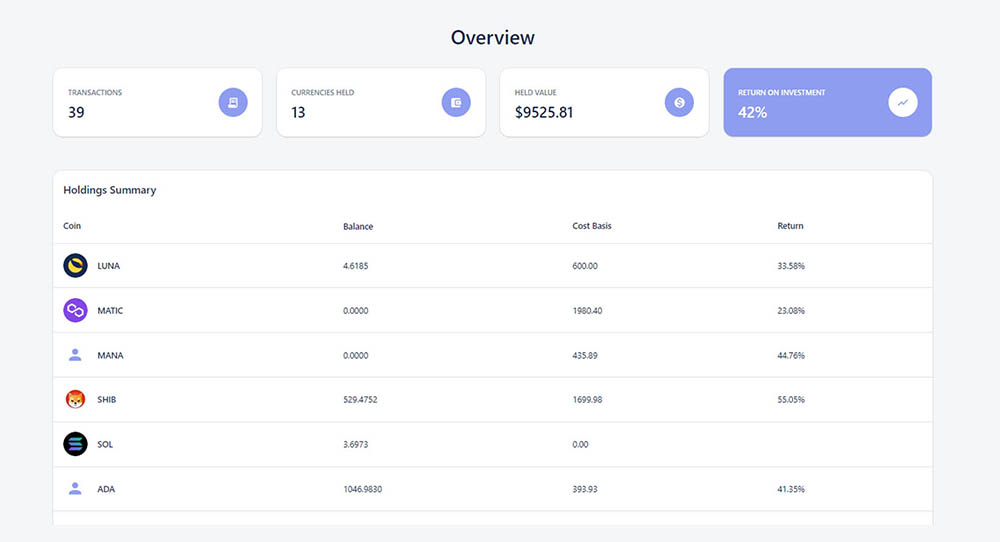

Visualize your entire crypto investment landscape and stay informed about your tax obligations. Our platform is the ultimate tool for tracking your portfolio’s evolution, offering a clear window into your holdings, performance, and taxable events.

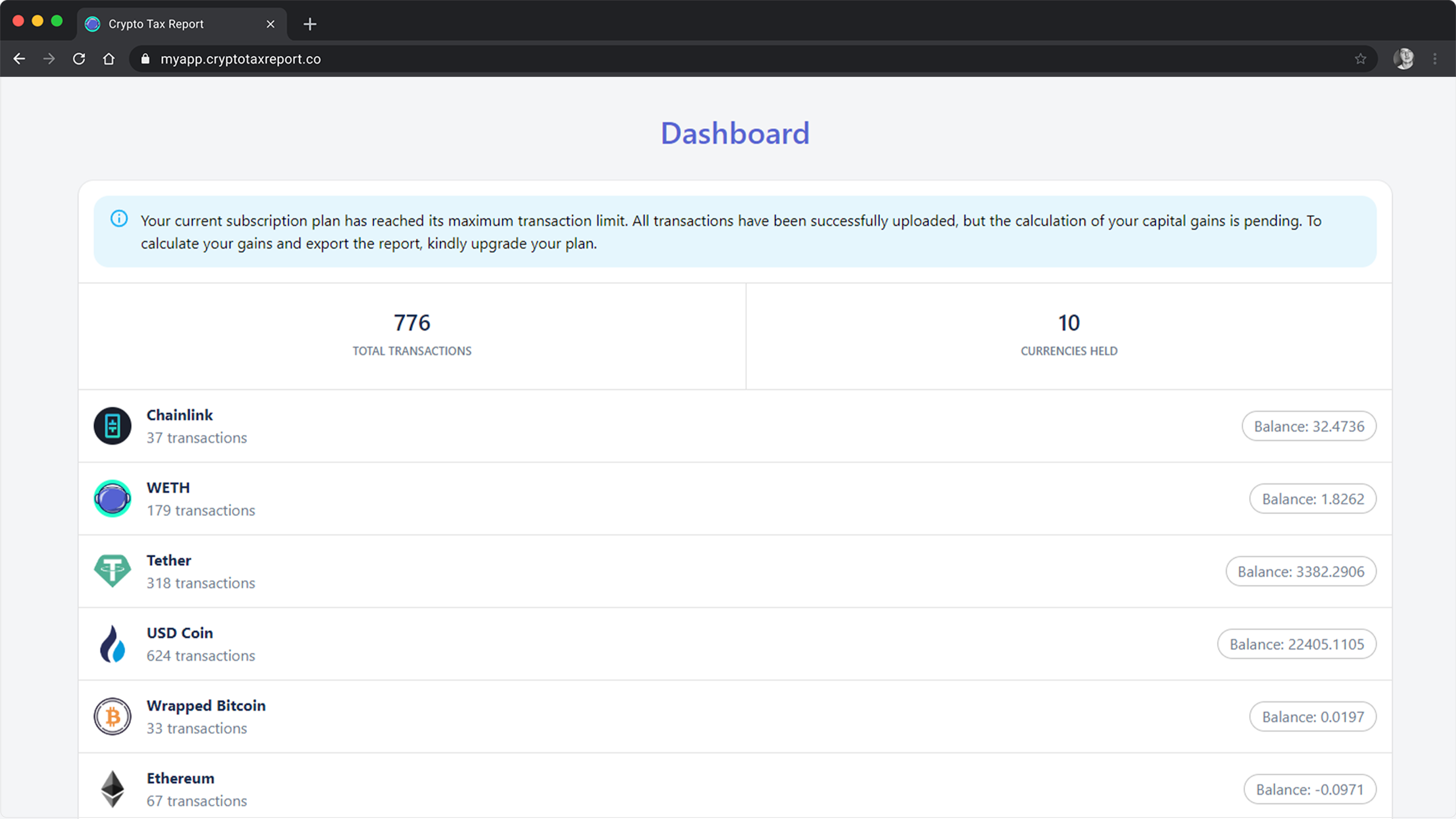

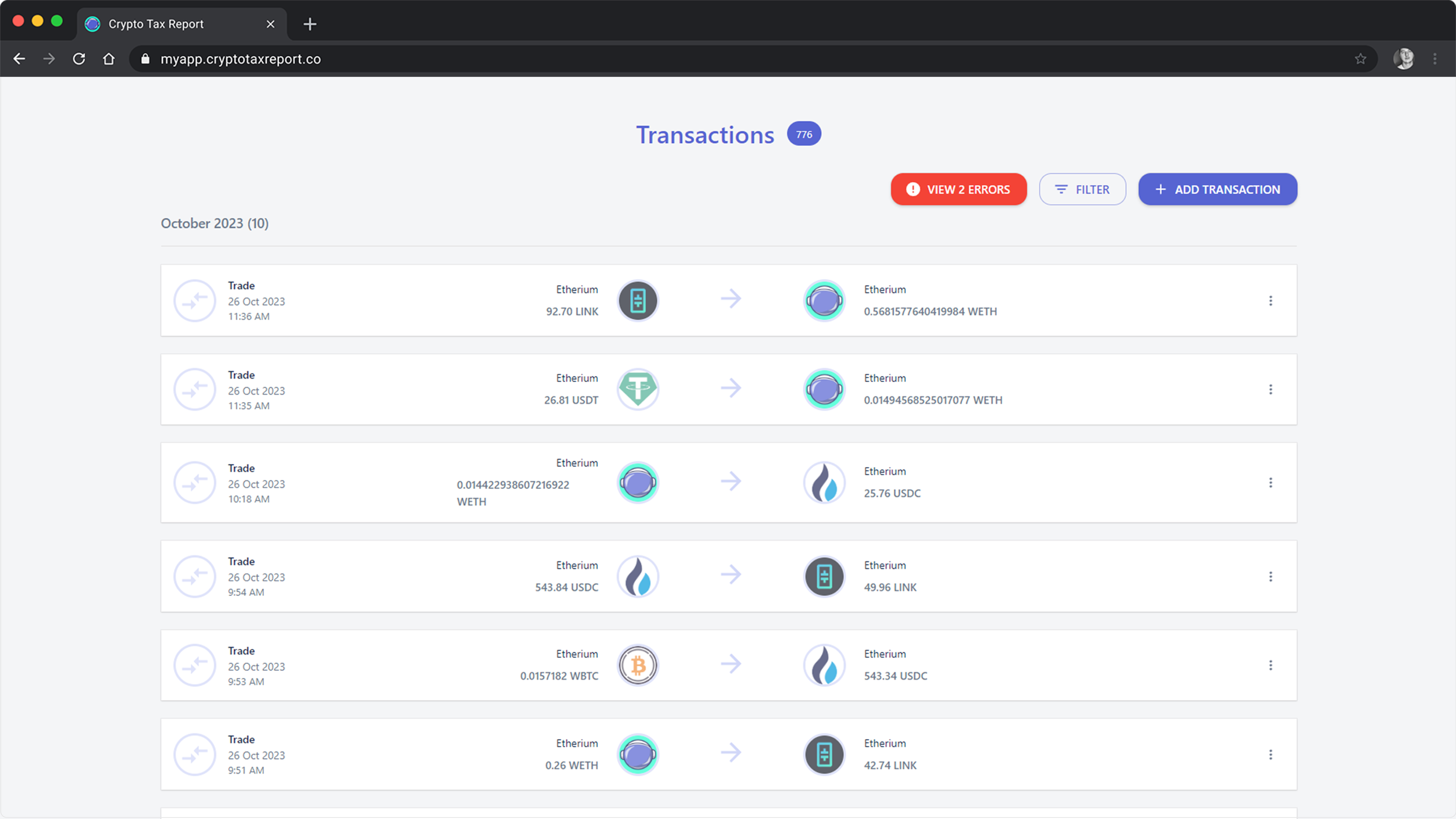

Bid farewell to the hassle of juggling multiple accounts and wallets. With our streamlined data synchronization, every transaction is meticulously logged, ensuring a complete and transparent record of your trading activity.

Track how you’re doing with mining, staking, lending and of course, trading.

See your total ROI and a breakdown for each crypto you own

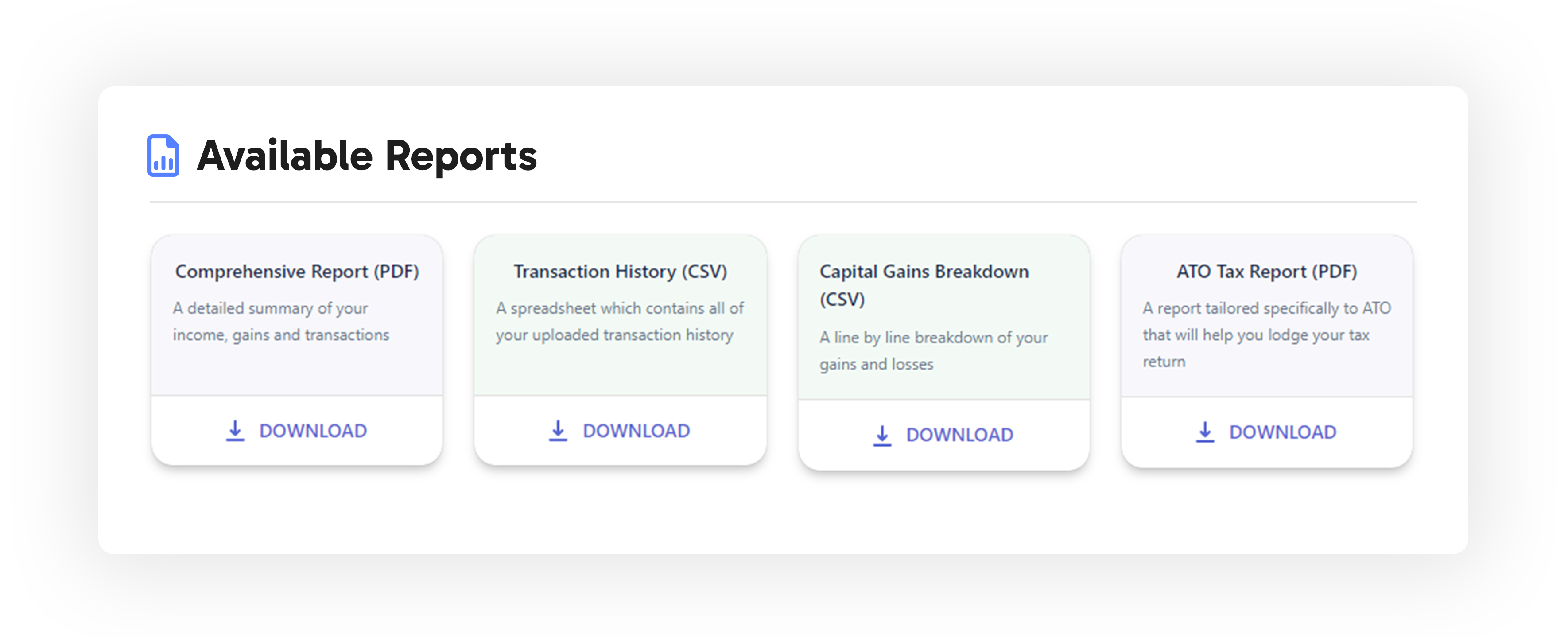

Get a sneak peek at your capital gains and tax estimates without a penny due. When you’re set, generate the tax forms you need with confidence.

Wave goodbye to tax report inaccuracies. Our platform comes equipped with robust tools to detect and address any discrepancies, ensuring your Ethereum and broader crypto transaction history is impeccable.

Don’t see the answer to your question here? Check out our Help Center or send us an email.

Tax auditors are intensifying their scrutiny of crypto capital gains. Exchanges are required to disclose their users’ transactions, providing tax auditors with the means to identify individuals who have failed to report their capital gains on their tax returns. Stay proactive in reporting your crypto capital gains to prevent the repercussions of a potential audit.

Crypto tax is calculated by determining the taxable events, such as buying, selling, trading, or earning cryptocurrency, and then calculating the associated gains or losses. The specific method and rules for calculating crypto tax can vary depending on the country’s tax laws and regulations. Generally, you need to track the cost basis (purchase price) and the fair market value of your crypto at the time of each transaction. By subtracting the cost basis from the proceeds, you can determine the capital gain or loss.

Seems complicated? That’s okay, Crypto Tax Report can do all of this for you!

While we advise consulting with your accountant to review your records, it’s worth considering that your accountant might be utilizing a costly crypto tax software for calculating your tax liability. This expense could be passed on to you. A more cost-effective alternative is to use our service, generate a report, and forward it to your accountant. This approach can help streamline the process and potentially reduce unnecessary expenses.

Respecting your privacy is of utmost importance to us. Therefore, we only collect the essential information necessary to assist you in calculating your tax returns. Rest assured that all the data we collect is treated with the highest level of confidentiality. Read our privacy policy

In order to prioritize the safety and security of your information, we do not store any of your payment data within our system. Instead, we utilize a trusted third-party provider called Stripe for all payment processing. Stripe is an industry-leading payment processing platform widely utilized by numerous websites on the internet, ensuring top-level security standards.

With our subscription pricing, you can calculate your crypto taxes for multiple years, not just the current tax year. By opting for an annual subscription, you gain the ability to assess your crypto taxes as far back as 2014. The process remains straightforward: simply upload your transaction history from those years, Crypto Tax Report will notify you if your plan doesn’t have enough transactions to process your capital gains review and tax forms, choose the appropriate plan, and we will take care of the rest.

Our annual subscription encompasses all prior tax years, providing comprehensive coverage. Should you require any amendments to your tax returns for previous years, they will be included under the single payment. Additionally, we offer a 14-day money-back guarantee, ensuring your satisfaction. If you reach out to our support team within this period, you can receive a full refund without any hassle.

To get in touch with us, send us an email at hello@cryptotaxreport.co.