How is Crypto Taxed?

Cryptocurrency taxation depends on how it’s used. If you trade, sell, or use crypto for purchases, it’s subject to capital gains tax. Conversely, if you earn crypto through mining, staking, or as payment, it’s treated as income and taxed accordingly. Understanding these distinctions is key for accurate reporting.

Do You Need to Pay Taxes on Crypto?

Yes, if you engage in cryptocurrency transactions in the US, you’re subject to taxation. Whether it’s trading, selling, earning, or using crypto for purchases, these transactions are taxable events and must be reported in your tax filings.

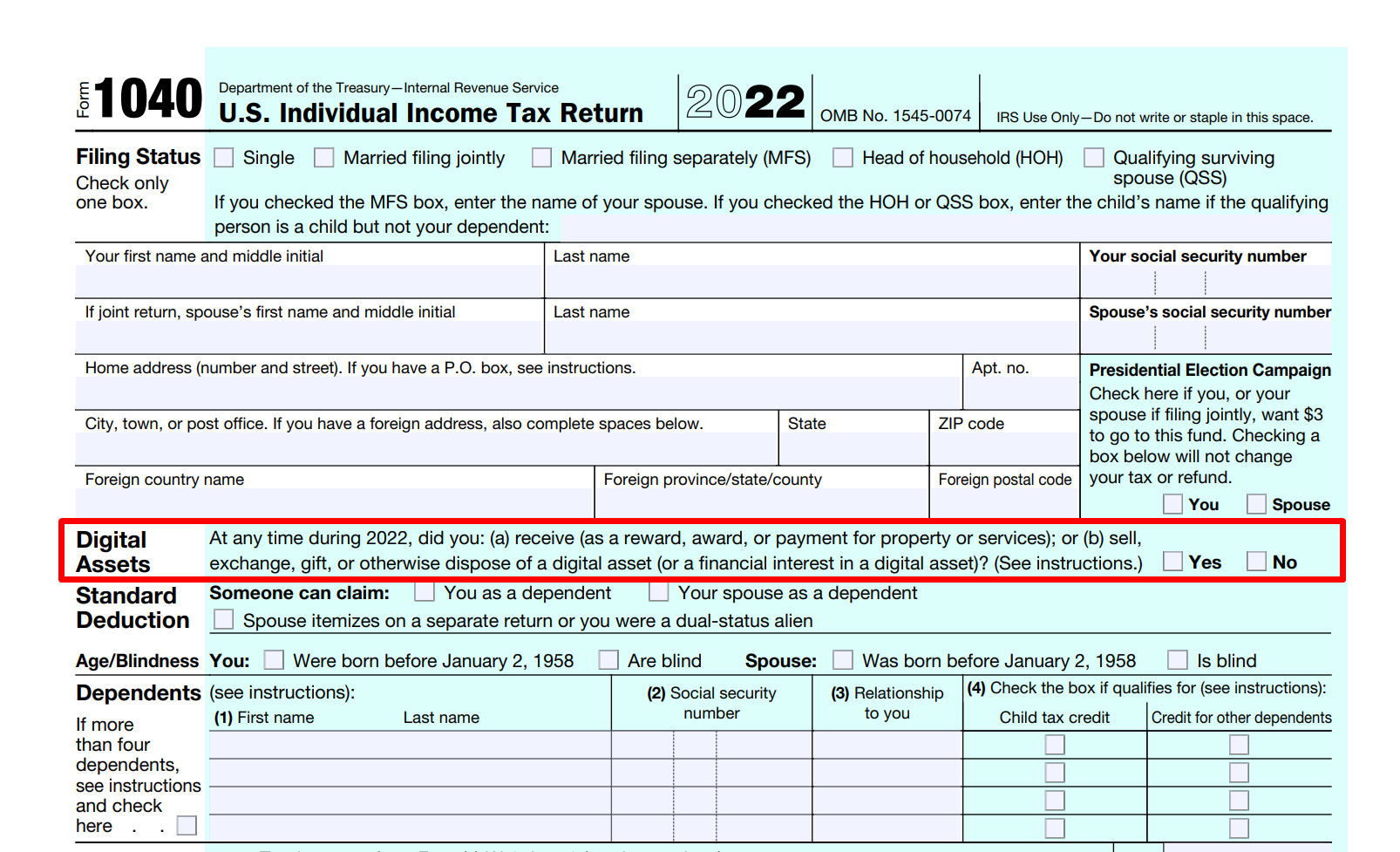

American taxpayers are required to complete Form 1040, which includes a specific query about cryptocurrency transactions in the tax year 2022. This makes it challenging to conceal any crypto-related activities from the IRS. Every individual dealing with cryptocurrencies must carefully consider their reporting obligations for the 2022 tax year.

Digital asset inquiries on Form 1040 enable the IRS to verify the accuracy of reported cryptocurrency capital gains. Failing to declare these transactions truthfully, especially if you’ve had dealings in crypto during 2022, could lead to IRS scrutiny and potential legal issues.

If you check “Yes” on Form 1040, the IRS can double-check that you have reported the capital gains from cryptocurrencies correctly. If you have received, sold, or traded any cryptocurrency during 2022 and you check “No“, you might get in trouble with the IRS if they discover that you have been withholding information about your tax situation.

How is Crypto Taxed in the US?

In the US, crypto is taxed as property. This means any gains realized from selling or trading crypto are subject to capital gains tax. Similarly, any crypto earned, like mining rewards or payment for services, is taxed as income at your applicable income tax rate.

What Crypto Transactions are Taxable in 2023?

In 2023, taxable crypto transactions include selling, trading, converting crypto to fiat, using crypto for purchases, and earning crypto through mining or staking. Keeping track of these transactions is essential for accurate tax reporting.

Do You Pay Taxes on Cryptocurrency?

Yes, in the US, any gains or income from cryptocurrency transactions are subject to taxation. This includes profits from trading, earnings from mining or staking, and any other form of crypto-based income.

When Do You Owe Taxes on Your Crypto?

You owe taxes on your crypto whenever you realize a gain or earn crypto income. A gain occurs when you sell or trade crypto for more than your cost basis. Earning crypto, whether through mining, staking, or as payment, also triggers a taxable event.

How Much is Crypto Taxed in the USA?

Crypto taxation in the USA depends on your income bracket and how long you’ve held the crypto. Short-term capital gains (for assets held less than a year) are taxed at your regular income rate, while long-term gains are taxed at lower rates (0%, 15%, or 20%).

What is the Crypto Tax Rate?

The crypto tax rate varies. For short-term gains, it aligns with your income tax bracket (up to 37%). Long-term gains (for crypto held over a year) are taxed at 0%, 15%, or 20%, depending on your income.

Crypto Tax Rates for 2023

In 2023, the crypto tax rates remain aligned with the standard capital gains tax brackets. Short-term gains are taxed at your income tax rate, while long-term gains are subject to 0%, 15%, or 20% tax, based on your income level.

Tax Rates in the USA

Tax rates in the USA vary based on income and filing status. They range from 10% to 37% for income tax, and 0%, 15%, or 20% for long-term capital gains, including gains from cryptocurrency held for more than a year.

Income Tax

Income tax applies to cryptocurrency earned through mining, staking, airdrops, or as payment for services. The rate depends on your total income and can range from 10% to 37%, following the standard IRS tax brackets.

| Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 10% | $0 – $10,275 | $0 – $20,550 | $0 – $10,275 | $0 – $14,650 |

| 12% | $10,276 – $41,775 | $20,551 – $83,550 | $10,276 – $41,775 | $14,651 – $55,900 |

| 22% | $41,776 – $89,075 | $83,551 – $178,150 | $41,776 – $89,075 | $55,901 – $89,050 |

| 24% | $89,076 – $170,050 | $178,151 – $340,100 | $89,076 – $170,050 | $89,051 – $170,050 |

| 32% | $170,051 – $215,950 | $340,101 – $431,900 | $170,051 – $215,950 | $170,051 – $215,950 |

| 35% | $215,951 – $539,900 | $431,901 – $647,850 | $215,951 – $323,925 | $215,951 – $539,900 |

| 37% | $539,901+ | $647,851+ | $323,926+ | $539,901+ |

Capital Gains Tax (CGT)

Capital Gains Tax on crypto applies when you sell or trade your cryptocurrency at a profit. Short-term gains (held under a year) are taxed as ordinary income, while long-term gains (held over a year) benefit from reduced rates of 0%, 15%, or 20%.

| CGT Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 0% | $0 – $41,675 | $0 – $83,350 | $0 – $41,675 | $0 – $55,800 |

| 15% | $40,401 – $459,750 | $80,801 – $517,200 | $40,401 – $258,600 | $54,101 – $488,500 |

| 20% | $459,751+ | $517,201+ | $258,601+ | $488,501+ |

How to Calculate Capital Gains on Crypto

Calculate your crypto capital gains by subtracting the purchase price (cost basis) from the selling price. Remember to include transaction fees in your cost basis for an accurate calculation.

Is Buying Crypto Taxed in the US?

Buying crypto with fiat in the US isn’t a taxable event. However, the subsequent sale, trade, or use of that crypto for purchases can result in capital gains taxes.

Is Selling Crypto Taxed in the US?

Yes, selling crypto in the US is taxed. If you sell crypto for more than you paid, you’ll owe capital gains tax on the profit. The tax rate depends on how long you held the crypto and your income level.

Paying for Goods or Services

Using crypto to pay for goods or services is a taxable event in the US. The IRS views it as a sale of property, and any gain realized from the transaction is subject to capital gains tax.

Tax-Free Cryptocurrency Transactions

Tax-free crypto transactions include transferring crypto between your wallets, buying crypto with fiat and holding it, and gifting crypto (within the annual gift tax exclusion limit).

Tax on Cryptocurrency Mining

Mining cryptocurrency is taxable as income at its fair market value when received. Additionally, any increase in value upon selling the mined crypto is subject to capital gains tax.

Tax on Staking Rewards

Staking rewards in cryptocurrency are considered taxable income at

their fair market value at the time of receipt. These rewards are also subject to capital gains tax upon their sale or exchange.

Margin and Futures Trading

Gains from margin and futures trading in crypto are subject to capital gains tax. Losses can offset other capital gains or up to $3,000 of income, with additional losses carried forward.

Tax on DeFi and NFTs

DeFi earnings and profits from NFT sales are subject to taxation. DeFi income is taxed as ordinary income, while NFT sales are subject to capital gains tax.

Crypto Gifts and Donations

Gifts of crypto are tax-free below the annual exclusion limit. Donations to qualified charities are not taxable and can be deductible, based on the asset’s market value at the time of donation.

Other Cryptocurrency Transactions

Other taxable crypto transactions include earning crypto from airdrops, hard forks, or as bonuses. Each has its specific tax implications, often treated as ordinary income.

How to Calculate Your Crypto Taxes

To calculate your crypto taxes, record all taxable transactions, determine each transaction’s cost basis and proceeds, and calculate the gain or loss. Sum these figures to find your total taxable amount.

How to File Your Crypto Taxes

To file your crypto taxes, complete IRS Form 8949 for capital gains and losses, and include these figures in Schedule D of your tax return. Report any crypto income on Schedule 1 or C, depending on its nature.

Crypto Tax Software to Make Filing Your Crypto Taxes Easier

Crypto tax software automates the process of calculating and reporting your crypto taxes. It aggregates all transactions, calculates gains and losses, and generates necessary tax forms for filing.

How the IRS Tracks Your Crypto Taxes

The IRS tracks crypto taxes through data-sharing with exchanges, analyzing blockchain transactions, and using Form 8949 and other tax documents filed by taxpayers.

Can the IRS Track Your Cryptocurrency?

Yes, the IRS can track cryptocurrency through various means, including information from exchanges, public blockchain data, and matching reported transactions on tax returns.

What Happens if You Don’t Report Your Crypto Taxes?

Failing to report crypto taxes can lead to penalties, interest, audits, and even criminal prosecution for tax evasion. It’s crucial to accurately report all taxable crypto transactions.

How Do You Lower Your Crypto Taxes?

Lower your crypto taxes by holding assets for over a year for lower long-term capital gains rates, using losses to offset gains, and taking advantage of tax-advantaged accounts and charitable donations.

How Can I Reduce My Crypto Capital Gains Tax?

Reduce your crypto capital gains tax by holding assets long-term, engaging in tax-loss harvesting, and strategically planning your trades and sales throughout the tax year.

When Do You Need to Report Your Crypto Taxes?

Crypto taxes need to be reported annually by the IRS tax filing deadline, which is typically April 15th. It’s important to include all taxable crypto events in the relevant tax year.

IRS Crypto Tax Deadline 2023

The IRS crypto tax deadline for the 2023 tax year is April 15, 2024. Ensure all crypto transactions for 2023 are accurately reported by this date to avoid penalties.

What if You Forgot to Report Your Crypto Taxes?

If you forgot to report your crypto taxes, you can file an amended return using Form 1040X. It’s better to voluntarily correct the oversight than to wait for an IRS audit.

How to Report Your Crypto Taxes in the US

Report your crypto taxes in the US by completing IRS Form 8949 for capital gains and losses, Schedule D for summarizing these gains, and including any crypto income on your standard tax return.

When to Report Your Crypto Taxes

Crypto taxes should be reported annually at the same time as your regular tax filing. The deadline is typically April 15th of the year following the tax year in question.